Art Auction Trends: Insights from Christie’s Recent Sale

The recent auction at Christie’s in New York, which showcased the collection of Louise Riggio, illustrated notable shifts in the art market. With a total sales figure of $272 million, the auction, held on a Monday evening, failed to meet pre-sale expectations, prompting discussions about the current state of art collecting.

Economic Influences on Art Sales

The atmosphere at the auction was marked by subdued energy, contrasting sharply with the vibrant bidding of previous years. Experts have pointed to economic uncertainty, particularly concerning President Trump’s tariffs, as a potential detractor from buyer enthusiasm. Auctioneer Adrien Meyer noted a challenging environment for engaging bidders, as evidenced by the lukewarm response to some items, including a terra-cotta vase by Picasso that eventually sold for $567,000, within its estimated range.

The Riggio Collection Outcome

Louise Riggio consigned a significant collection that included nearly 40 works accumulated during her marriage to Leonard Riggio, founder of Barnes & Noble. Although the total amount generated appeared impressive at $272 million, the sale fell short of Christie’s pre-sale estimates, which had set a low target of $252 million when excluding fees.

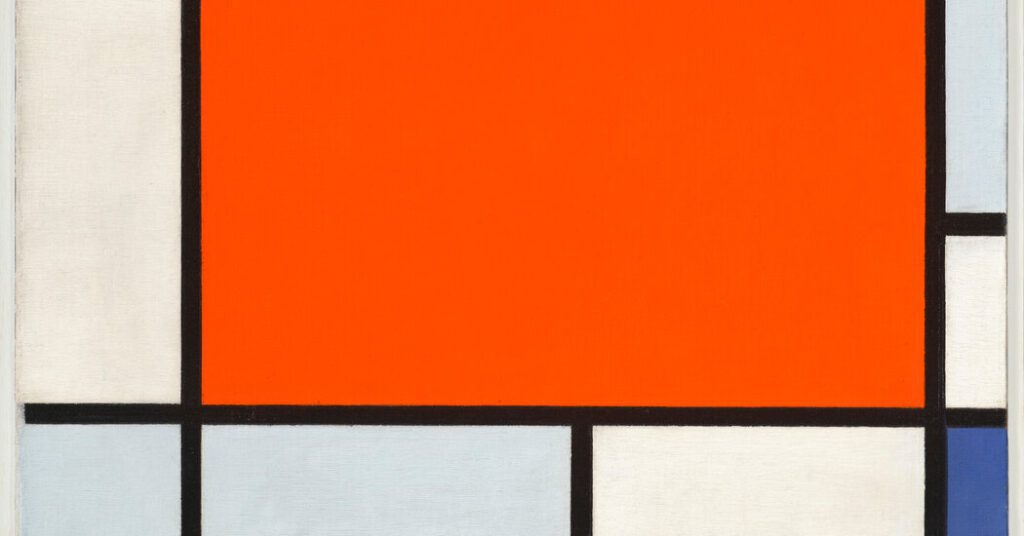

A standout piece from the collection was a 1922 painting by Piet Mondrian, “Composition with Large Red Plane, Bluish Gray, Yellow, Black and Blue,” which sold for $47.6 million but did not surpass the previous record for a Mondrian piece, which was set at $51 million just three years prior at Sotheby’s.

Market Reaction and Future Implications

According to art dealer Brett Gorvy, the lack of a bidding war for the Mondrian was influenced by its aggressive initial valuation—estimated at around $50 million. He explained, “Overpricing at the start was a deterrent with many collectors, despite the quality and rarity of the work.” This perspective reflects broader concerns about collector sentiment in a shifting marketplace.

20th Century Evening Sale: A Mixed Performance

Following the Riggio auction, Christie’s hosted the 20th Century Evening Sale, which recorded total sales of $217 million, narrowly surpassing its low estimate of $194 million. Challenges arose during the event when the auction house withdrew Andy Warhol’s “Big Electric Chair,” estimated at $30 million, further illuminating the current frailty in the Warhol market.

However, there were notable successes, such as paintings by Gerhard Richter, Vincent van Gogh, and Helen Frankenthaler, which sold above their estimated ranges, indicating pockets of demand amid overall market wariness.

Notable Sales and Market Observations

A particularly vibrant moment occurred during the sale of Claude Monet’s “Peupliers au Bord de l’Epte, Crépuscule,” which fetched nearly $43 million after an intense five-minute bidding contest, aligning with its estimated range of $30 million to $50 million. This sale offered hope for collectors, illustrating that reputable pieces still attracted significant interest.

Market Adjustments

Despite some victories, not all transactions reflected robust health in the art market. For example, a work by Lucio Fontana, which previously sold for nearly $14 million in 2017, was resold for just $7.5 million, showcasing a remarkable decline.

Bonnie Brennan, CEO of Christie’s, characterized the auction results as strong but acknowledged a desire for more spirited bidding. Commentary from Alex Rotter, Christie’s global president, echoed this sentiment, emphasizing the need for active engagement in the current market landscape.

As the first major auction of the season, the Riggio collection sale offers critical insights into the shifting dynamics of the art market as it heads into further major auctions at Christie’s, Sotheby’s, and Phillips, which together aim for combined sales exceeding $1.2 billion.